-

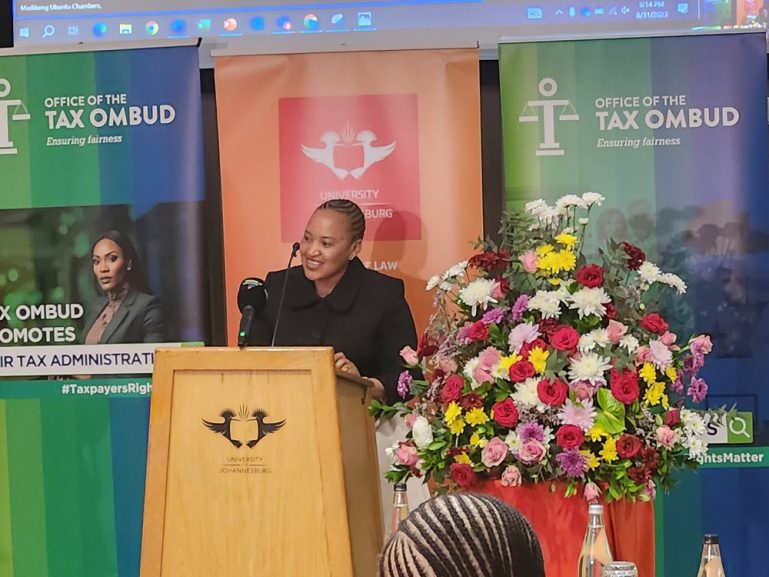

[FILE IMAGE]: Yanga Mputa giving a Public Lecture on “Making Taxpayers Rights Matter”. Ms Mputa was hosted by the Faculty of Law at UJ.

The Office of the Tax Ombud has found that eFiling profile hijacking is most prevalent among tax practitioners and individual taxpayers.

The draft eFiling profile hijacking report notes that the majority of cases involve Personal Income Tax and Value-Added Tax (VAT).

It found that vulnerabilities in the eFiling system include inadequate authentication processes, challenges in fraud detection, delayed South African Revenue Services response times, insider threats, and low digital security awareness among taxpayers.

The report has been published for public comment, with the closing date for submissions scheduled for the 31st of October 2025.

Tax Ombud Yanga Mputa says, “The majority of cases are those that involve Personal Income Tax and VAT. Because people will get into your profile, redirect the refund and then pay it into their account, which is why it involves a lot. Another thing is that the amounts that are involved range between R10,000 and R100,000. So, this implies that they target taxpayers who are middle income because to have a high refund … you must have a lot of income.”

MEDIA STATEMENT: OTO publishes Draft Report into alleged E-filing Profile Hijacking for public comment.

The closing date for submissions is 31 October 2025. The draft report follows a systemic investigation conducted by the OTO into alleged eFiling profile hijacking.

Media…

— Tax Ombud SA (@TaxOmbud) October 1, 2025