-

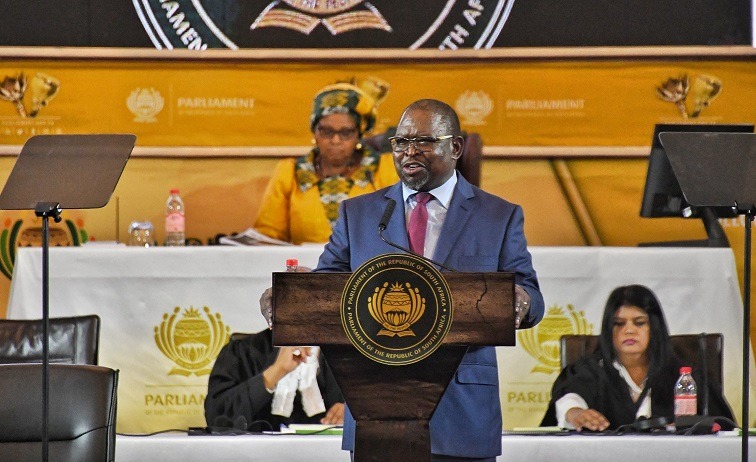

Finance Minister Enoch Godongwana delivering his Budget Speech.

Analysts predict that the government’s finances will continue to face significant strain as long as economic growth remains sluggish and debt levels keep climbing.

This outlook comes as Finance Minister Enoch Godongwana prepares to deliver the highly anticipated Budget Speech, which was postponed last month due to disagreements within the government of national unity’s (GNU) cabinet.

The Budget Speech, among others, aims to balance economic growth and support for the vulnerable in our society despite limited resources. This will be the first budget under the GNU.

Economic growth disappointed, recording a mere 0,6% in 2024, which fell below the National Treasury’s 0,8% growth expectations.

Experts say poor growth translates to tax revenue collections being less than expectations.

Independent Economist Ntombi Mbele-Thomo elaborates, “What we have been actually been able to get as revenue for the year 2024 is much lesser than what we anticipated. So that puts strain on the fiscus. You know, it’s further strained by what they already have in being able to service their debt-to-GDP interest rates.

“You know that is already telling you that SA is not in the best economic trajectory in terms of growth and it begs the question of whether the 1.9% that’s been forecasted for 2025 will materialise when they have rebase the growth to 0.6%,” Mbele-Thomo adds.

National Treasury had hoped to raise nearly R60 billion in additional revenue for the 2025/26 financial year through new tax proposals.

Tax Partner at Forvis Mazars, Graham Molyneux says, “If we could trim down the wasteful expenditure, get rid of corruption, debloat for lack of a better description and collect the taxes that is due, I think if one does that, one perhaps doesn’t even needs look at tax increase at all.”

“I know those are probably more medium to longer term things, they won’t happen overnight – that’s the problem, I think. If this budget goes ahead on the 12th, we need some kind of short-term solution on the table to balance the budget. I suppose there is going to be tax or elements of taxation that will help to balance the budget in the short term,” explains Molyneux.

The Budget Speech impacts citizens’ daily lives by addressing issues such as jobs, energy, infrastructure, grants, taxation, safety, climate change, youth unemployment, and education. -Additional reporting by Velemseni Mthiyane