-

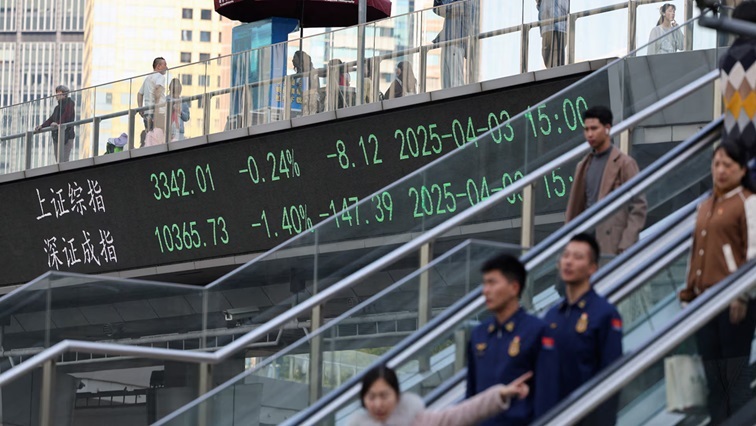

An electronic board shows Shanghai and Shenzhen stock indices as people walk on a pedestrian bridge at the Lujiazui financial district in Shanghai, China April 3, 2025.

China and Hong Kong shares rose on Thursday, as investors downplayed the latest US tariff increase on Chinese imports and pinned their hopes on talks between the world’s two largest economies and market and policy support from state firms.

China’s blue-chip CSI300 Index and the Shanghai Composite Index both rose 1.4% as of 0235 GMT.

Hong Kong’s benchmark Hang Seng was up 3.5%.

The rise in Hong Kong shares also followed a 6% surge in Chinese internet companies listed on the US market overnight after US President Donald Trump temporarily cut the steep tariffs he had just imposed on dozens of other countries.

Trump at the same time escalated tariffs on China to 125% from the 104% level that just took effect on Wednesday.

“Investors believe the marginal effect of raising tariffs further from the existing level will shrink, as most Chinese exports to the US have already been greatly affected,” UBS analysts said in a note to investors.

“Some optimistic investors still believe in the end, the two sides will sit down and make a deal.” Kai Zhan, international partner at Chinese law firm Yuanda, said announcements overnight showed “Trump is using tariffs as a negotiation tactic rather than acting irrationally.”

Zhan said the market was also expecting that the White House’s temporary tariff exemptions for other countries provided China with opportunities to reroute its exports.

Tech majors traded in Hong Kong climbed 4.2%. China on Wednesday raised additional duties on American products to 84% and imposed restrictions on 18 US companies, mostly in defence-related industries.

“We believe Beijing views these US trade actions as nothing short of a declaration of economic war, not just a trade dispute.

The US-China confrontation is set to escalate from here,” said analysts from BCA Research in a note.

The analysts downgraded Chinese offshore stocks from neutral to underweight. “Uncertainty still lingers, and the stock market’s ups and downs are tied to the US President’s mood.

It’s becoming really tough for investors, especially institutions, to navigate,” said Zeng Wenkai, chief investment officer at Shengqi Asset Management Co. Capital Economics analysts said they doubted Beijing or Washington would back down from their trade war in the next few days but would eventually talk.

“Our long-standing assumption that the effective tariff rate on China would settle around 60% still seems like the best bet,” they said in a note.

Mainland and Hong Kong stocks have held up relatively well this week through a global stock rout on expectations Beijing will do more to shield the economy from tariffs.

China has said it will take resolute and effective measures to safeguard its rights and interests in response.

It also released a White Paper that said Beijing was willing to communicate with Washington to resolve differences between the world’s two biggest economies.

Also, China’s biggest brokerages have pledged to help steady domestic share prices, the Shanghai bourse said, while scores of listed companies said they planned to buy stocks.

Chinese state holding companies, led by Central Huijin, have been supporting the stock market by increasing share investment.

Mainland investors bought Hong Kong shares worth a net HK$ 35.5 billion ($4.46 billion) via the Stock Connect scheme on Wednesday, the highest on record.

VIDEO | TrumpTariffs – 90-day pause for some countries, 125% for China: