-

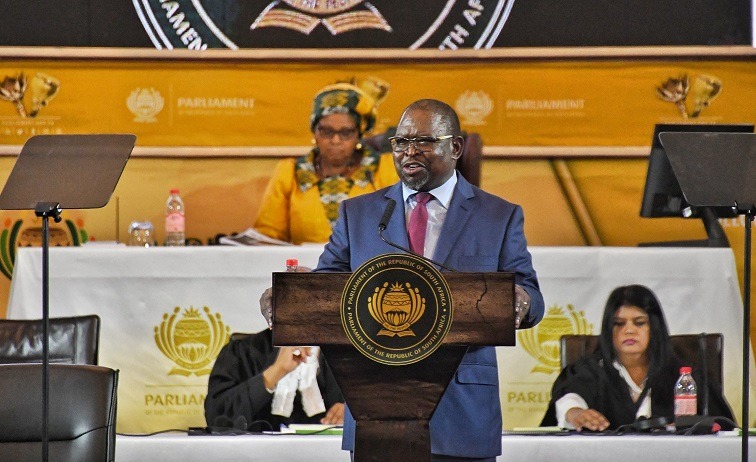

Finance Minister Enoch Godongwana delivering his Budget Speech.

Experts attending the pre-National Budget Speech roundtable hosted by Deloitte, agree that while there have been some green shoots, South Africa’s financial position remains constrained.

Economists expect the upcoming Budget Speech to outline economic projections similar to those presented in the Medium-Term Budget Policy Statement (MTBPS).

Finance Minister Enoch Godongwana will deliver his Budget Speech on Wednesday next week (19 February), his first under the Government of National Unity.

It will set out the long-term goals for the country and how the government plans to allocate funds across the different priorities.

Some experts have raised questions about the funding sources for the spending outlined in the State of the Nation Address.

Deloitte Chief Economist Hannah Marais says the challenge going forward will be balancing stagnant revenue with the spending needs of the country, while enabling growth.

Marais outlines that the risk of fiscal slippage could lead to an even higher budget deficit which is expected to be over 75% of GDP.

“That’s said, I think a lot of good momentum, particularly in terms of economic reforms, which has also come through in the MTBPS you know, particularly also looking at the second phase of ‘Operation Vulindlela’, ultimately broadening some of the reforms that are already underway.”

“They are starting to bear fruits. So ultimately alleviating basic supply side constraints to growth largely linked to the electricity sector. And increasingly also to linked to the logistics rail and freight sector will unlock growth in the medium term,” adds Marais.

Despite the geopolitical uncertainty and the diplomatic rift between the US and South Africa, economists believe there are still many opportunities for the country.

Deloitte Associate Director Africa Tax And Legal, Mamohlwa Mohlola says investment in SARS will contribute positively toward revenue collection.

Mohlola says, “I believe that is going to help the revenue authority in coming up with infrastructure that will help the revenue authority in coming up with infrastructures that will help them collect a lot of money and data analyzing from the taxpayers.”

“So, from a company’s perspective, I believe that you know, being February, a lot of companies have year ends or aligned with their financial. They will be submitting a lot of returns, a lot of professional tax returns.”

“So, there will be a lot of collections from that perspective from an individual perspective I believe that with the implementation of the 2-pot retirement reform that was implemented in 2024. So yeah, I mean I’m looking forward to seeing whether SARS will meet their revenue [target] for the current year,” adds Mohlola.

Meanwhile, the Director focusing on Life Sciences and Healthcare at Deloitte, Wesley Solomon, weighed in on the implementation of the NHI.

“In terms of NHI, first the government should look at how do they currently spend any money on programs such as from central services, et cetera, and the provincial funding we seem we expect to be decreasing over time and substituted to fund NHI activities.”

“That will mostly be centered on these types of activities, so in contracting units of primary healthcare will be a small and closed area where the people know their needs. Know what’s required to run that. I could call it a cup and then funding gets decanted from the provincial Department of Health into funding those activities. We fund a lot already and there’s a lot of money available for NHI,” explains Solomon.

At the same time experts anticipate an ongoing debate on the implementation of the Social Relief of Distress Grant which could deepen the fiscal crisis.